- Visitor:32

- Published on: 2025-05-03 01:03 pm

‘TARIFF’-YING TURN OF THE WORLD ORDER

While India stands to lose approximately $5 trillion due to sustained tariffs, analysts believe it will remain a resilient economy, as evidenced by the recent rebound in the Sensex. Should the U.S. fail to achieve its stated goal of becoming a "manufacturing powerhouse," global production may shift toward countries like India. This presents a strategic opportunity for India to subsidize manufacturing facilities and temporarily exempt select products from taxation. With higher reciprocal tariffs on countries like Vietnam and China, India could capture a greater share of the smartphone manufacturing market—a sector where it has previously missed similar opportunities.

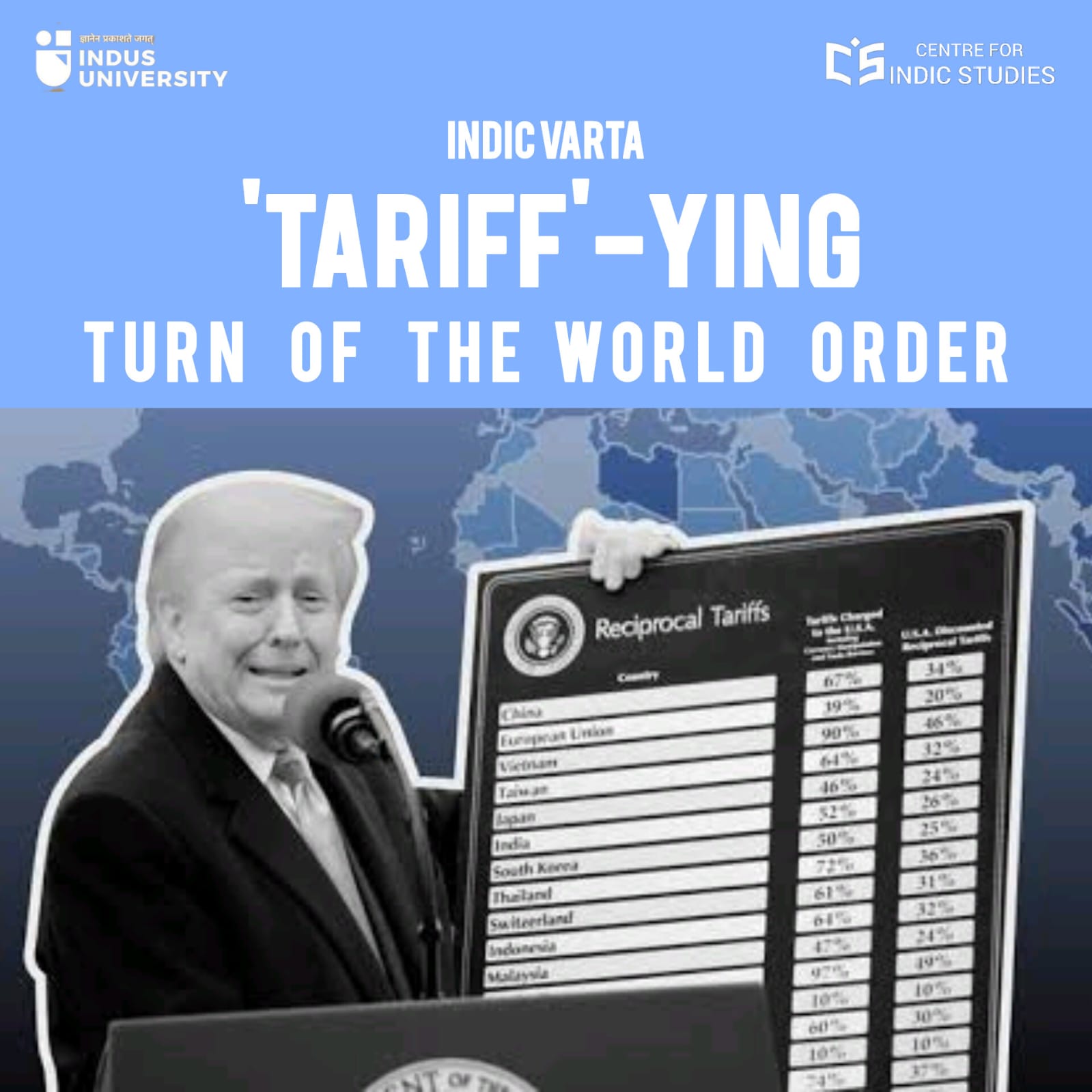

April 2nd, 2025 was celebrated by the Trump administration as 'Liberation Day' as it extended its 'America First' trade strategy. The U.S. government announced higher tariffs on American exports to "level the playing field" by matching or exceeding the trade barriers imposed by other countries on American goods. This move was framed as a response to decades of trade deficits and alleged "unfair trade practices" by foreign governments. The policy also aims to combat "de-industrialisation", revive American industries, transform the nation into a "manufacturing powerhouse," and protect U.S. jobs.

The tariffs follow a structured pattern: a baseline tariff of 10% will be levied on all product types, regardless of their country of origin. In addition, the Trump administration has determined a minimum tariff of 25% on automobiles, identifying that sector as particularly of concern. Moreover, countries will face ‘discounted reciprocal tariffs’, which EU has claimed to counter with retaliatory tariffs on American products. The European Union will face a 20% tariff, while India will be subject to a 26% tariff. According to the U.S. President, this approach is intended to create symmetry in global trade policies.

Supporters of the policy describe it as bold and necessary, claiming it will restore economic sovereignty and encourage the renegotiation of trade agreements. Critics, on the other hand, warn of significant drawbacks, including price hikes, disruptions in supply chains, inflation, and a potential recession. Retailers, in particular, have expressed concern over inflated consumer prices.

Globally, reactions have been swift and critical. China responded with a 34% counter-tariff, matching the U.S. levy. The European Union labelled the move protectionist and vowed to retaliate, even filing a complaint with the World Trade Organization. The United Kingdom, facing a 10% reciprocal tariff, called the measure devastating, warning of long-term consequences for Trans-Atlantic trade. Australia criticized the move as "illogical and unfriendly," while Singapore’s Prime Minister deemed it protectionist and suggested it marked a shift toward a "changing world order." Amid these developments, Goldman Sachs raised the probability of a U.S. recession to 35%, up from a previous estimate of 20%, citing concerns over the impact of the Trump tariffs.

A report by Aston University, published as a Financial Times Report, found that the immediate economic impact would be most severe for North America, the European Union, Canada, and Mexico. As of April 8, 2025, the Hong Kong Stock Exchange had dropped by 13%, while the Taiwan Stock Exchange declined by over 9%.

While India has not issued an official position, it announced plans to revise trade policies to mitigate the effects. President Trump claimed that the impact on India would be limited, despite previously referring to India as a "tariff king". In reality, while India historically imposed high tariffs on American goods, these rates have declined since the Nirmala Sitharaman-led Finance Ministry assumed office. The 26% reciprocal tariff on Indian goods, which was put into effect on April 9, 2025, is said to primarily target textiles, pharmaceuticals, and IT hardware. India currently enjoys a trade surplus of $45.7 billion with the United States, a figure that adds context as readers advance to the next segment of the article.

On April 7, following the announcement of the reciprocal tariffs, Indian stock markets experienced a steep decline. The Sensex fell by 3,000 points, marking the ‘worst single-day decline’ in ten months and wiping out ₹20.16 lakh crore in investor wealth—resulting in an overall decrease of 5% in the market. Interestingly, markets recovered the next day, with the Sensex rising by 1,000 points in early trading on April 8, and analysts reported that panic selling had subsided. Although pharmaceutical tariffs have not yet been announced, President Trump warned they would be set at a level "never seen before" and be disclosed in the "not too distant future." As a result, pharmaceutical stocks—including Aurobindo Pharma, Laurus Labs, IPCA Labs, and Lupin—fell by 8%.

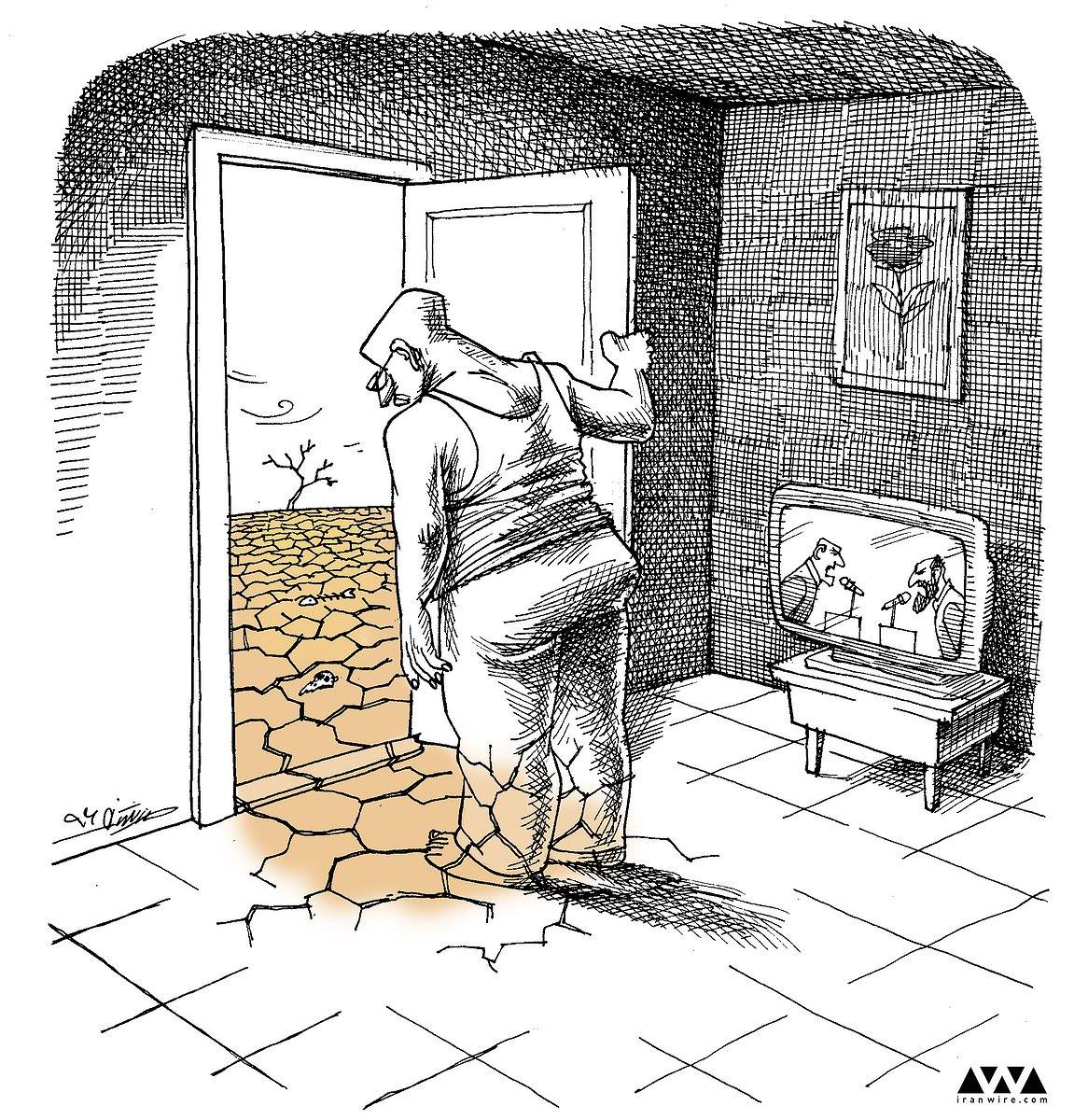

In an interview, India’s External Affairs Minister S. Jaishankar described the new U.S. policy as an attempt to alter the very world order it had once helped create. He called the development a significant "churn" and predicted that "the world will not be the same again."

The American administration has employed a non-standard formula to determine these tariffs. While it claims the policy fosters symmetry in trade, it actually bases tariffs on the U.S. trade deficit with individual countries. Analysts argue that trade deficits are not solely driven by tariffs but are also influenced by factors such as consumer behaviour, currency exchange rates, and global supply chain dynamics. Moreover, this methodology overlooks actual product-level trade flows - For example, if Country A exports high-value electronics while Country B exports lower-value agricultural goods, the resulting trade deficit will naturally skew against Country B. Thus, equating bilateral trade imbalance with unfair trade practices is considered flawed.

The administration's formula works as follows: the trade deficit with a country is divided by the total U.S. imports from that country to obtain a percentage imbalance. This figure is then halved to determine the tariff rate. For instance, with China, the U.S. trade deficit is $295 billion and total imports amount to $439 billion. Dividing 295 by 439 yields an imbalance of approximately 67.2%, which, when halved, results in a 33.6% tariff on Chinese imports. Economists criticize the halving mechanism, arguing that it lacks any economic basis and disproportionately penalizes countries like Germany and Japan, which may maintain lower tariffs on American goods but still hold a significant trade surplus.

Nilesh Shah, Managing Director of Kotak Mahindra Mutual Fund, warned that such tariff wars have historically triggered prolonged recessionary periods. He cited past examples where similar trade conflicts led to economic slowdowns lasting as long as 15 years.

The post-World War II Bretton Woods Conference in 1944, which established a new economic and security order lasting until 1973. Another global shift emerged in the early 1980s with the Reagan-Thatcher era, marking the beginning of the neoliberal world order. The Smoot-Hawley Tariff Act of the 1930s represented the last major American tariff surge before the recent policy. The current situation is reminiscent of that era, and with 15% of the American economy dependent on imports, the projected cost of this new tariff regime is estimated at $1.4 trillion.

Ironically, the country poised to suffer the most may be the United States itself, due to retaliatory tariffs, disruptions in automotive supply chains, production relocations, and noticeable price increases in key commodities like steel and aluminium. This raises questions about the feasibility of turning the U.S. into a true "manufacturing powerhouse," especially considering the high cost of American labour. Competing with established manufacturing hubs such as China, South Korea, Vietnam, and India will be a formidable challenge.

Many of the regions in the U.S. that have potential for industrial revival or were historically manufacturing centers also form the core of President Trump's voter base. Vice President JD Vance cited China’s dominance in shipbuilding, noting that China has produced more ships than America did since World War II. However, the cost disparity is stark: a ship that costs $55 million to build in China would cost $300 million in the U.S. Reducing such costs without slashing wages may be politically untenable and could alienate the administration’s key supporters.

The U.S. also spends nearly $970 billion annually on its military, contributing to a federal debt of $36.22 trillion and a public debt of $26.5 trillion. This defence budget surpasses the combined military expenditures of the next ten countries, including China and India. Critics suggest that instead of relying solely on tariffs, the U.S. should also examine its outsized military spending as a potential avenue for fiscal reform.

While India stands to lose approximately $5 trillion due to sustained tariffs, analysts believe it will remain a resilient economy, as evidenced by the recent rebound in the Sensex. Should the U.S. fail to achieve its stated goal of becoming a "manufacturing powerhouse," global production may shift toward countries like India. This presents a strategic opportunity for India to subsidize manufacturing facilities and temporarily exempt select products from taxation. With higher reciprocal tariffs on countries like Vietnam and China, India could capture a greater share of the smartphone manufacturing market—a sector where it has previously missed similar opportunities.

Amid ongoing efforts by India and its BRICS counterparts to promote de-dollarisation, the global financial landscape may shift even further. For instance, China recently completed its first digital transaction with Thailand. In this context, U.S. Treasury Secretary Scott Bessent proposed categorizing countries into three buckets—green, yellow, and red—based on their exposure to reciprocal tariffs. India falls into the yellow bucket, suggesting that it may be relatively insulated from the broader economic fallout affecting the U.S., Canada, and, eventually the European Union.

- 16 min read

- 0

- 0